Mastering Financial Forecasting: AI-Driven Predictive Analytics for FP&A Professionals

From Team43

This article contains 4 sections:

What are the skills FP&A will need for the Information Age?

What is Financial Modeling?

Applying Linear Regression to Financial Forecasting: A Step-by-Step Guide

Why We Visualize Data?

What are the skills FP&A will need for the Information Age?

First, what is the Information Age?

the present time, in which large amounts of information are available because of developments in computer technology

Next lets define FP&A.

FP&A is an acronym for Financial Planning and Analysis. The responsibilities of the team may vary but the core functions are the same. FP&A's role is that of a strategic supporter to senior leadership. Where the focus should be on forward-looking financial analysis. Here are some of the many roles' FP&A teams preform:

Planning & Forecasting

Business Partnering & Financial Analysis

Month End Close & Reporting

Process Optimization

Yet often, FP&A teams succumb to the same trap, Excel. We covered this in the preceding articles (I & II). The learning was that many organizations currently run their business manually. While we mentioned some of the pitfalls as well as drawbacks to doing so. To take on the age of information, teams will need to cultivate the below skill sets:

Technology and Data Skills

Critical & Strategic Thinking

Digital Transformation

Predictive Analytics

These burgeoning skill sets reflect the demand exerted on FP&A teams today. The expectation is for professionals to be more strategic and tech-savvy. While also adhering to adaptability and vitality within the organization. As automation takes its place in departments, the focus shifts to critical thinking. This mindset must pair well with other fundamental skills. These include Digital Transformation, Predictive Analytics, and a thorough understanding of the business.

To drive value within an organization modeling the future is paramount. It relies on an understanding of the past, guided by assumptions of the future. Excel does a decent job with this using scenario-based approaches. For example, if Units or Price were to increase/decrease by X then Estimated Revenue would be Y.

Yet this simple approach does not meet expectations within the real world. It does not take into consideration theories such as Elasticity of Demand. Further, it does not give us an understanding of any relationships between variables. This is why machine learning (ML) is key when modeling future outcomes. With it we can provide confidence to our stakeholders with the information we communicate.

Price elasticity of demand is a measurement of the change in the demand for a product in relation to a change in its price.

What is Financial Modeling?

Let us start off with a simple question, why do we use modeling in Finance? The reason being that it helps business professionals make informed future decisions. Financial models project future financial performance based on historical data. This process involves data analytics & machine learning (ML) to create models for prediction. Yet there are other techniques which apply here too. It is up to the financial professional to make these decisions. While also establishing assumptions about future conditions. The best outcomes follow a mindful balance between human input and machine computation.

One of the key benefits of AI in finance is the ability to process vast amounts of data quickly and accurately. FP&A leaders must be skilled in managing this data to drive insights and decisions that add value to the business. With AI, financial analysis is no longer a manual process. Instead, it is more automated and data-driven, with algorithms and Machine Learning providing more accurate predictions and insights.

Let us now walk through a financial modeling exercise using the use case below.

We work within the Finance department at AcmeTech. AcmeTech is a leading manufacturer of smart home devices. Their flagship product, the HomePod, is an AI-powered smart speaker. AcmeTech's Finance team wants help forecasting Revenue to enable analysis and decision-making.

Here is a list of variables that the Finance team provided to us:

Revenue (Target to Predict) - The Total revenue generated from selling HomePod.

Orders - The number of HomePod units ordered.

Price - The average price invoiced to consumers.

Consumption - The Total usage of HomePods by consumers.

Customers- The Total number of customers captured by the company.

Inventory - The Total ending inventory of HomePods.

Let us explore how we can help the finance team achieve this using machine learning (ML) in Alteryx.

Applying Linear Regression to Financial Forecasting: A Step-by-Step Guide:

First let us run our variables through a Linear Regression model. The goal here is to predict Revenue using the relationship to other "independent" variables. The model will fit a straight line and plot the associated residuals. In this matter, residuals represent the predicted values to the actual values. The name of this process is multiple linear regression, as we are using five variables.

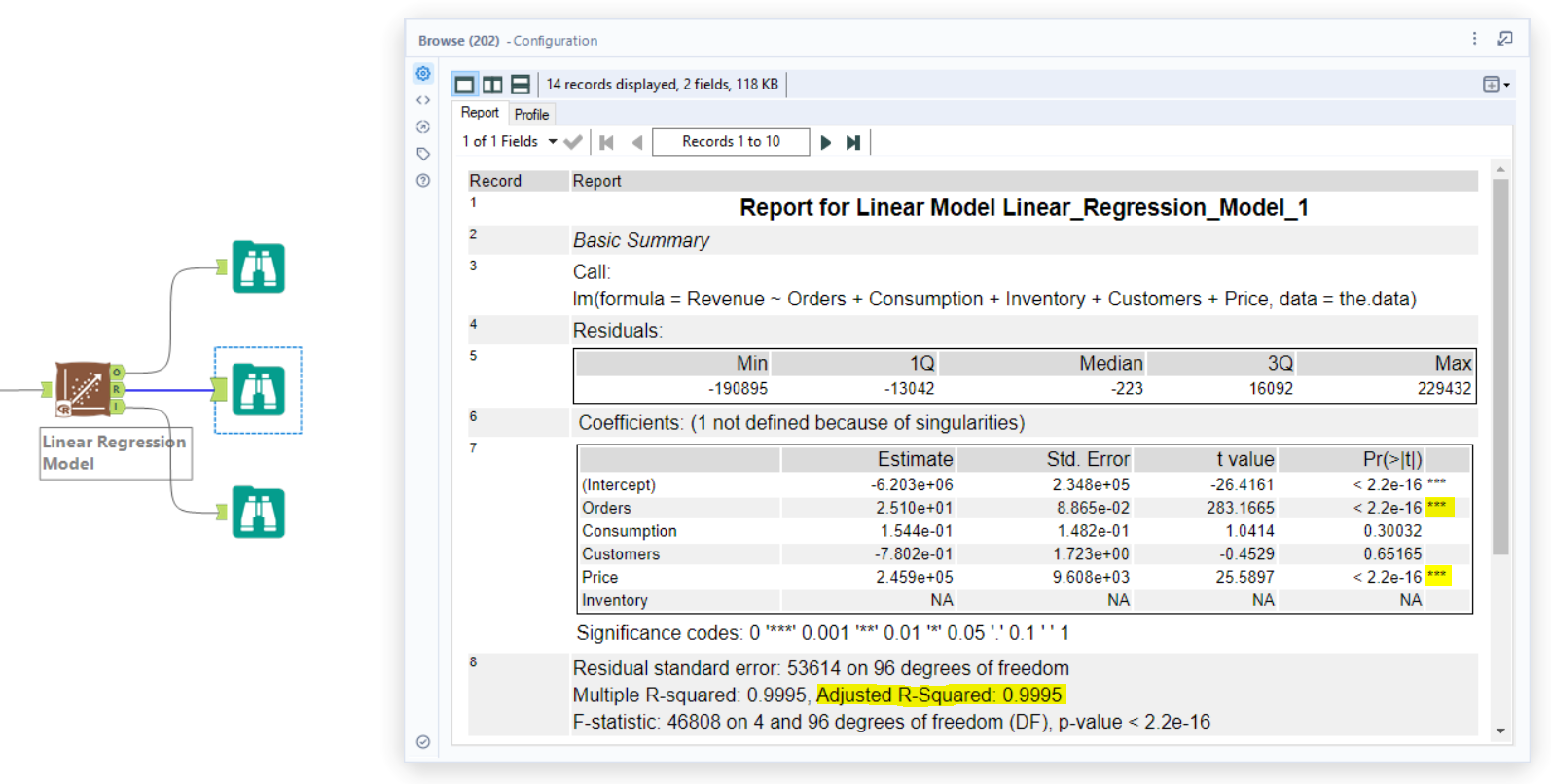

Step 1 - Linear regression model and output:

This is the output of our Linear Regression model using historical data. The sections to be aware of are the Coefficients (P-value) and Adjusted R-squared.

The last column within the Coefficients Table displays the respective P-values. The probability value displays the statistical significance of each variable to the Target (Revenue). A low P-value suggests that we can be confident that the coefficient is significant. Alteryx conveys this by displaying three asterisks (***).

Report of a Linear Regression model with Alteryx

The Adjusted R-squared value (0.9995) conveys to us useful information too. It represents the proportion of variance explained by the independent variables. In simple terms, it tells us how well our model explains the data. Yet it only counts the variables that are useful.

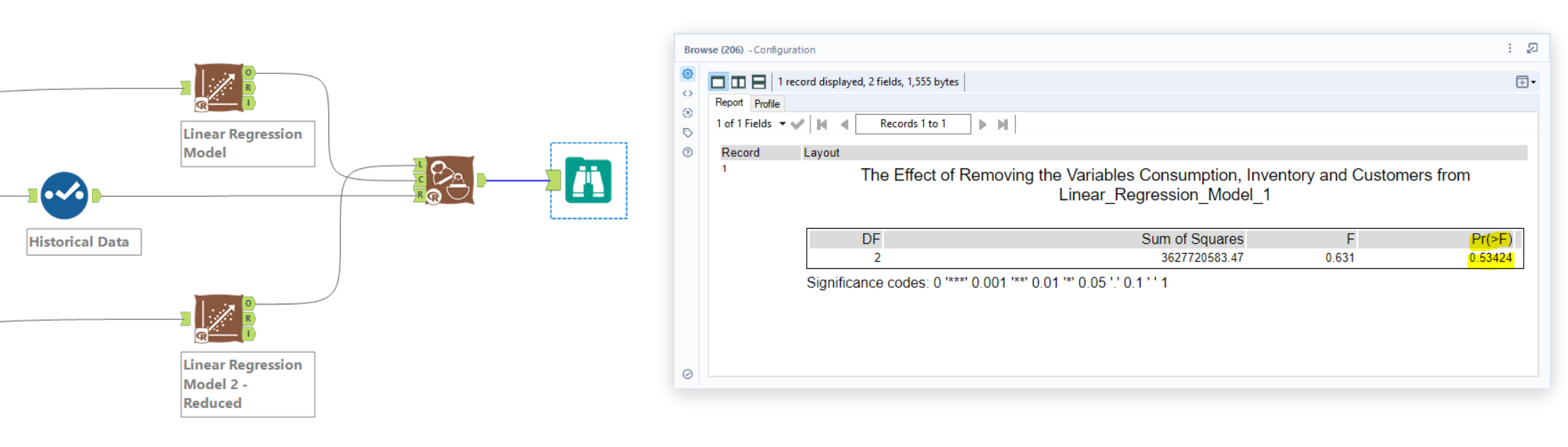

Step 2 - Reduce the number of dimensions:

On that last point, Adjusted R-squared only counts the variables that are useful. So let us evaluate for improvement by dropping unnecessary variables. We can oversee this in Alteryx using the Nested Test tool. To configure the tool, we will use our original regression model along with a new "reduced" model. The new model only retains Orders and Price.

Report of Nested Test within Alteryx

To interpret the results, call your attention to the last column [Pr(>F)]. This is significant because it tells us if the extra variables made a real difference. When the number is smaller than 0.05, then the extra variables make a difference. Yet in this example (0.53424), we can conclude that Price and Orders alone are adequate in predicting Revenue.

This is an important insight that you may not have caught. As a business stakeholder we must always reduce the noise. In this example, two variables are enough in forecasting Revenue. Let us focus our attention here on the signal and remove the noise.

Step 3 - Make some predictions:

This final stage is simple, we run our data through a predictive model and witness the results. But it does not stop there, you also must be able to interpret these results for communication. As well as continue testing different models for improvement. The Linear Regression tool provides a wealth of analysis showing the model's performance. Let us look at some high-level visualizations.

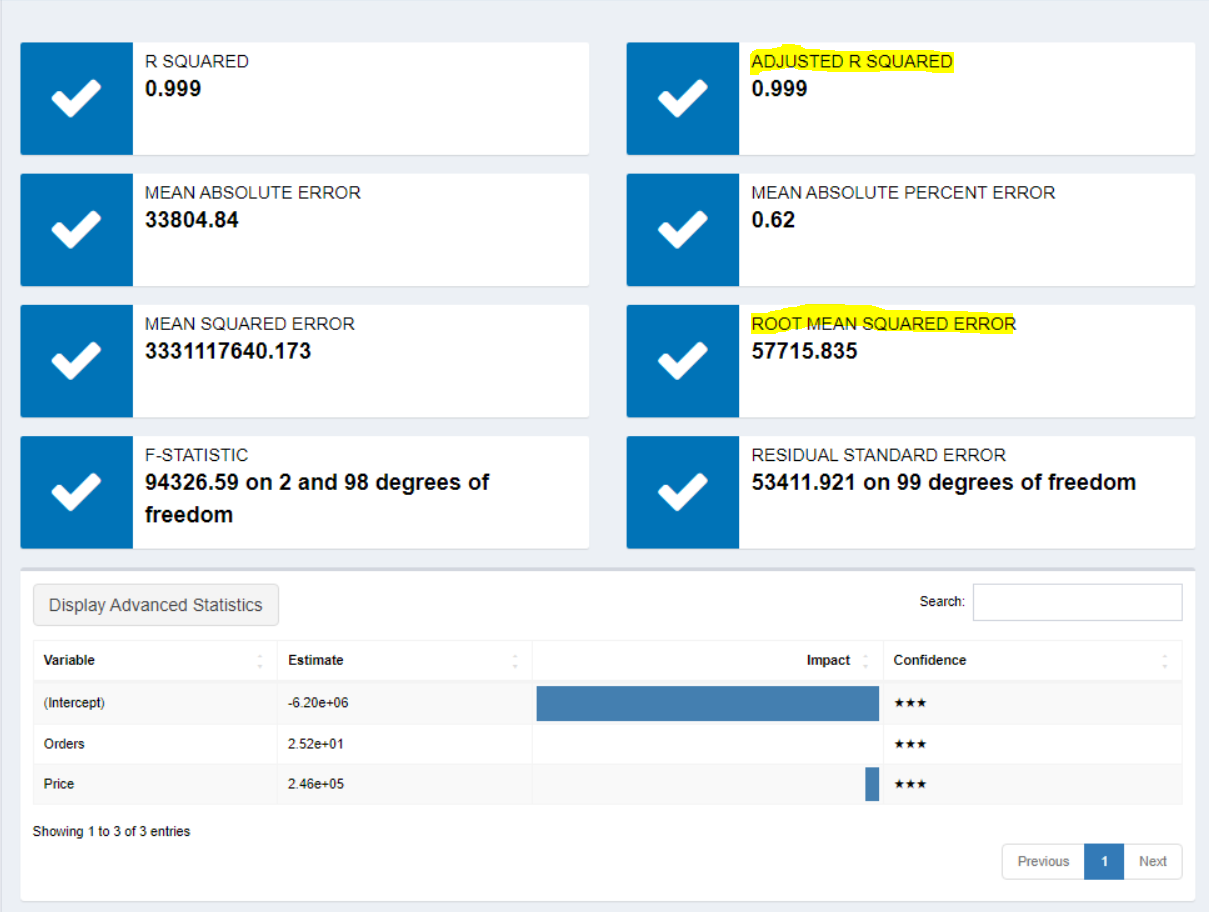

Model Summary

Summary of a Linear Regression model in Alteryx

This report displays a summary of the model. We already discussed Adjusted R-Squared, so we will not relay that topic. But another important metric to be aware of is Root Mean Squared Error. This single number evaluates the performance of the regression model. It measures the average size of prediction errors in the model. Note that every forecasting model should come with errors in the real world! Our job is to minimize these errors when possible.

In simple terms the RMSE of 57,716 tells us how good our guesses are. The best part about the metric is it is specific to our target variable. So, we can simply say, Revenue may be off by about $57,716 in our forecast.

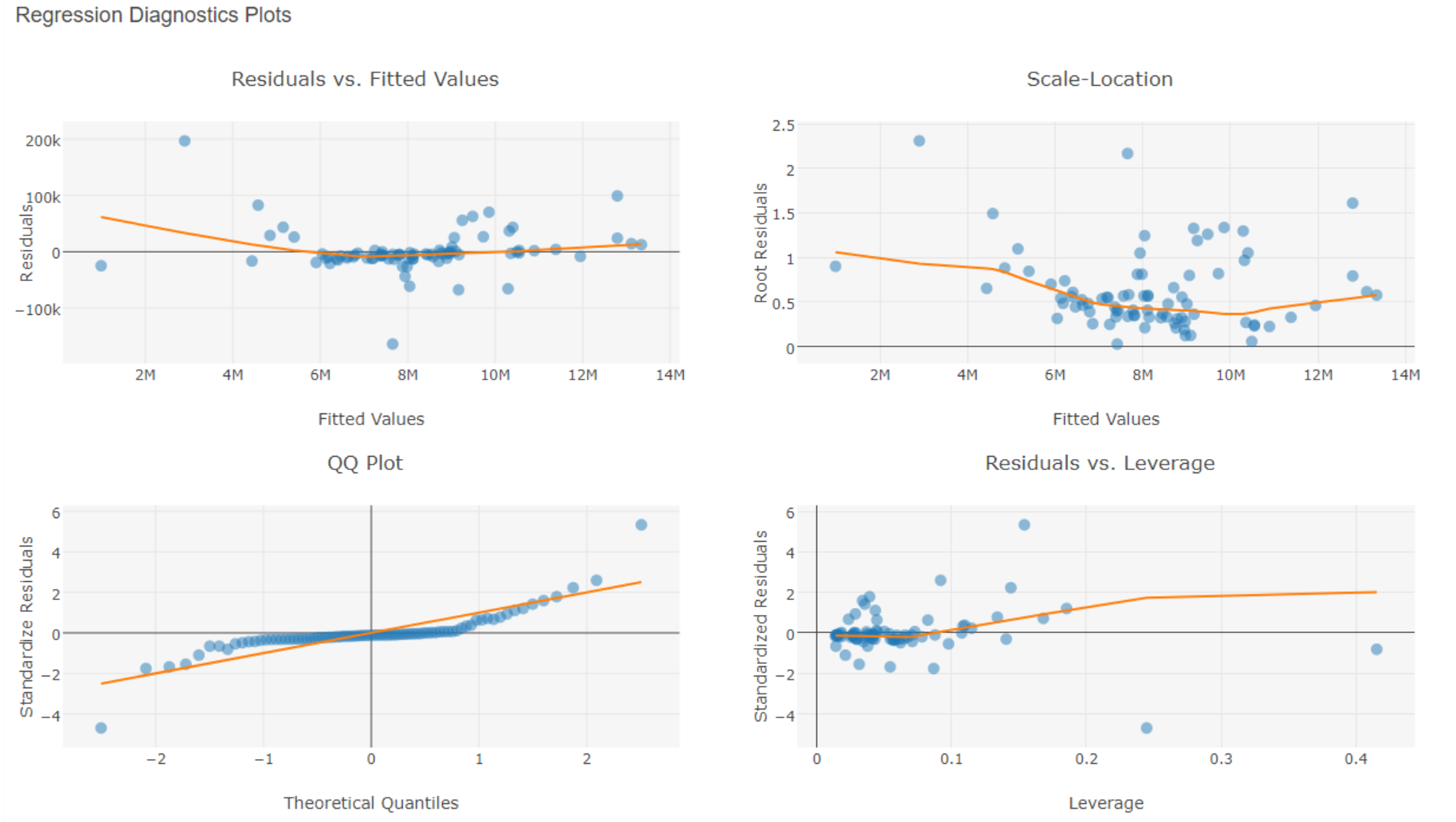

Regression Diagnostic Plots

Summary of Regression Diagnostic Plots in Alteryx

This topic is out of the scope of this article but worth sharing. Regression diagnostic plots help as a visual aid to assess the assumptions of our model. They help the analyst test whether the model meets key assumptions. When using linear regression there may be potential issues to address. These plots help us to correct for those.

Why we visualize data?

Effective communication is an essential reason we visualize data. Data Visualizations provide powerful tools to convey our findings to our stakeholders. Further, well-designed dashboards can aid in decision-making. It also provides a tool to allow for interactive exploration. All the above is our goal here. Provide our audience with a scenario-based forecasting tool which guides decisions.

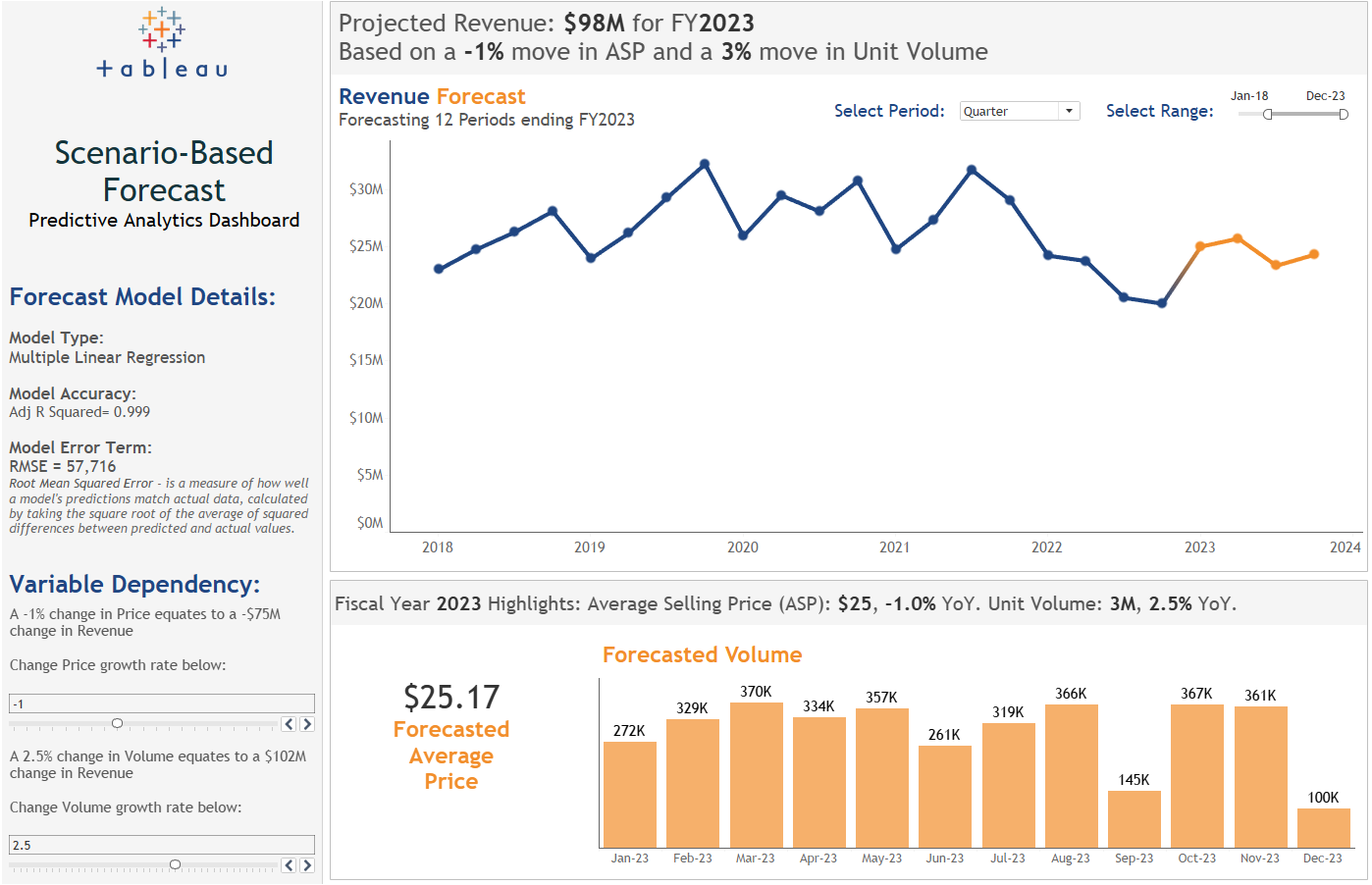

Check out the visualization below.

Scenario-Based Forecasting model displayed in Tableau

Going back to our use case, we are now ready to communicate our findings to the Finance team. We can confidently provide some analysis: Price and Units have a strong relationship when predicting future Revenue. And we can aid the department in decision-making: We project Revenue to be $98M based on a -1% decline in ASP and a 3% increase in Volume. But note, we may be $57K off in our prediction.

Using these insights, our Finance teams can make more informed decisions around these variables!

In summary, continue to hone your skills within your role under FP&A. As the future may seem daunting to some it excites me. Continue to find innovative ways to solve existing problems. And remember, technology is on your side. Use it to elevate your abilities and enhance your insight. Until next time!